- #Whats an invoice on account how to

- #Whats an invoice on account update

- #Whats an invoice on account pro

#Whats an invoice on account pro

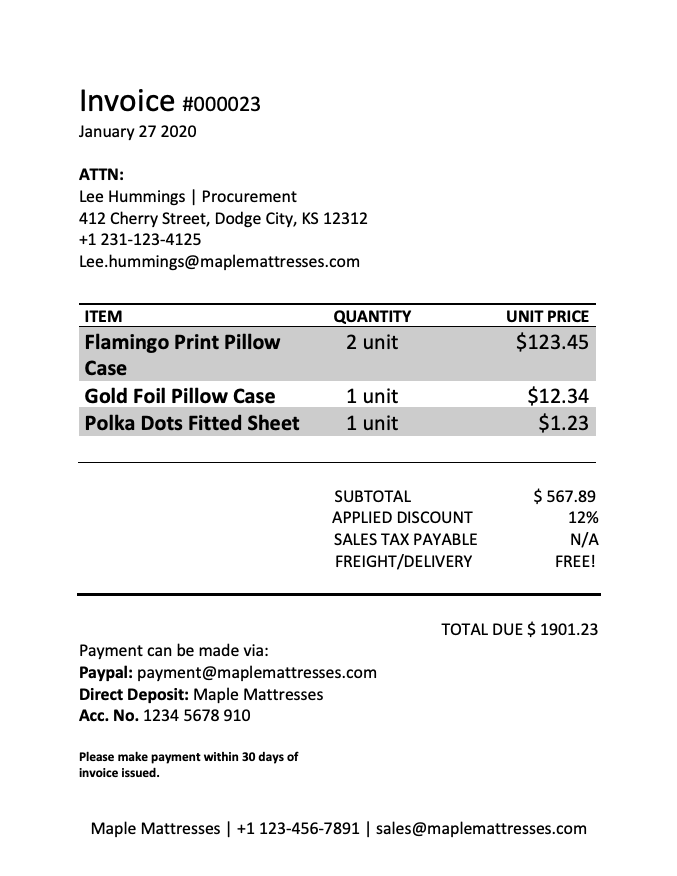

Pro Forma Invoice: An estimated price of a transaction before it has been agreed upon by the buyer and seller.Standard Invoice: Most common form of invoice that records a sale or transaction between seller and buyer, or business and customer.

The different types of invoices a business might issue include: Invoicing covers a wide range of source documents that record various types of transactions between two parties. What are the Different Types of Invoices? Therefore, an invoice is given to a customer, and once they have paid the amount on the invoice, the customer will receive a receipt as evidence that they paid the amount in full. On the other hand, a receipt is proof of payment for a sale. Are invoices receipts?Īn invoice is a document requesting payment, given to a buyer from the seller when a transaction occurs.

#Whats an invoice on account how to

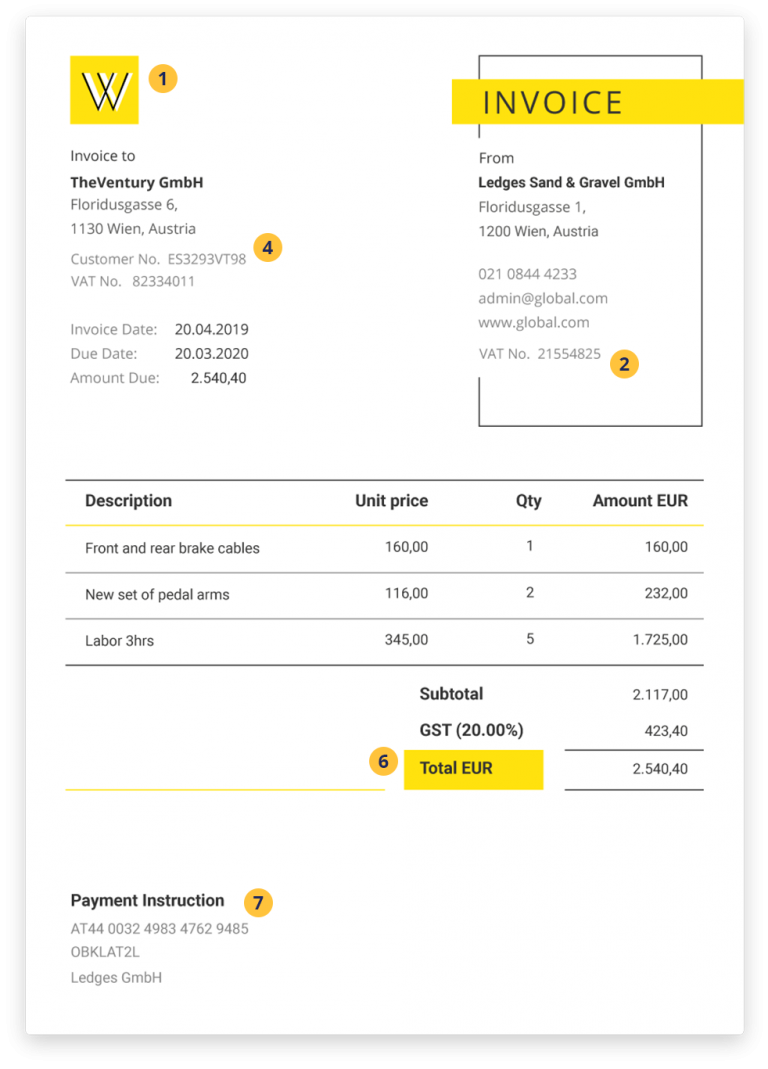

Learn how to create an invoice for your small business. Your business must record all sales to accurately calculate and file your taxes with the government for the calendar year.

#Whats an invoice on account update

This transaction record will then be used to update your business’s accounts, such as the sales ledger and your inventory list, making the invoice an essential part of the accounting process.

This invoice will tell the customer what they bought and how much they owe you. If a customer comes to your company and purchases a set of dishes, teacups, and saucers, you will need to provide them with an invoice for all the items sold. Suppose your business sells high-end dinnerware. Issuing an invoice to a customer means tracking a sale of a product for accounting and tax purposes, as well as inventory control. What is invoicing in accounting?Ī sales invoice is an essential part of the accounting aspect of a business as well, as it shows proof of sales that must be added to the business’s bookkeeping records. It spells out the terms of the deal, including what is being bought, how the payment should be made, who is receiving the product or service, and the transaction date and when it must be paid by. An invoice is used as a source document or proof of a transaction taking place between two parties.

0 kommentar(er)

0 kommentar(er)